About ORIT

We invest in Renewable Energy Assets to provide attractive and sustainable returns to investors. Our mandate spans Europe, the UK and Australia, offering opportunities for income and capital growth

Not loading? Try enabling functional cookies.

As an Impact Fund, we actively accelerate the transition to net zero through our investments, whilst offering investors access to an asset class fundamental to delivering a safe, secure, affordable future

ORIT provides an industry-leading level of diversification within the renewable energy sector, both by geography and technology, reducing concentration of risks and increasing the range of opportunities

Through our Investment Manager, Octopus Energy Generation, we have access to one of the largest teams of experts in the market

Overview - Key Metrics

(as of 30/06/2025)

£399m

Market capitalisation

99.5p

Unaudited NAV

per share

8.4%

Dividend Yield

1.54p

Q2 2025

Dividend Declared

6.17p

FY 2025

Dividend Target

Live Ordinary Share Price

£399m Market Capitalisation

(as at 30/06/2025)

10 December 2019 LSE Admission Date

Established Diversified Renewables Platform

Article 9 Under SFDR

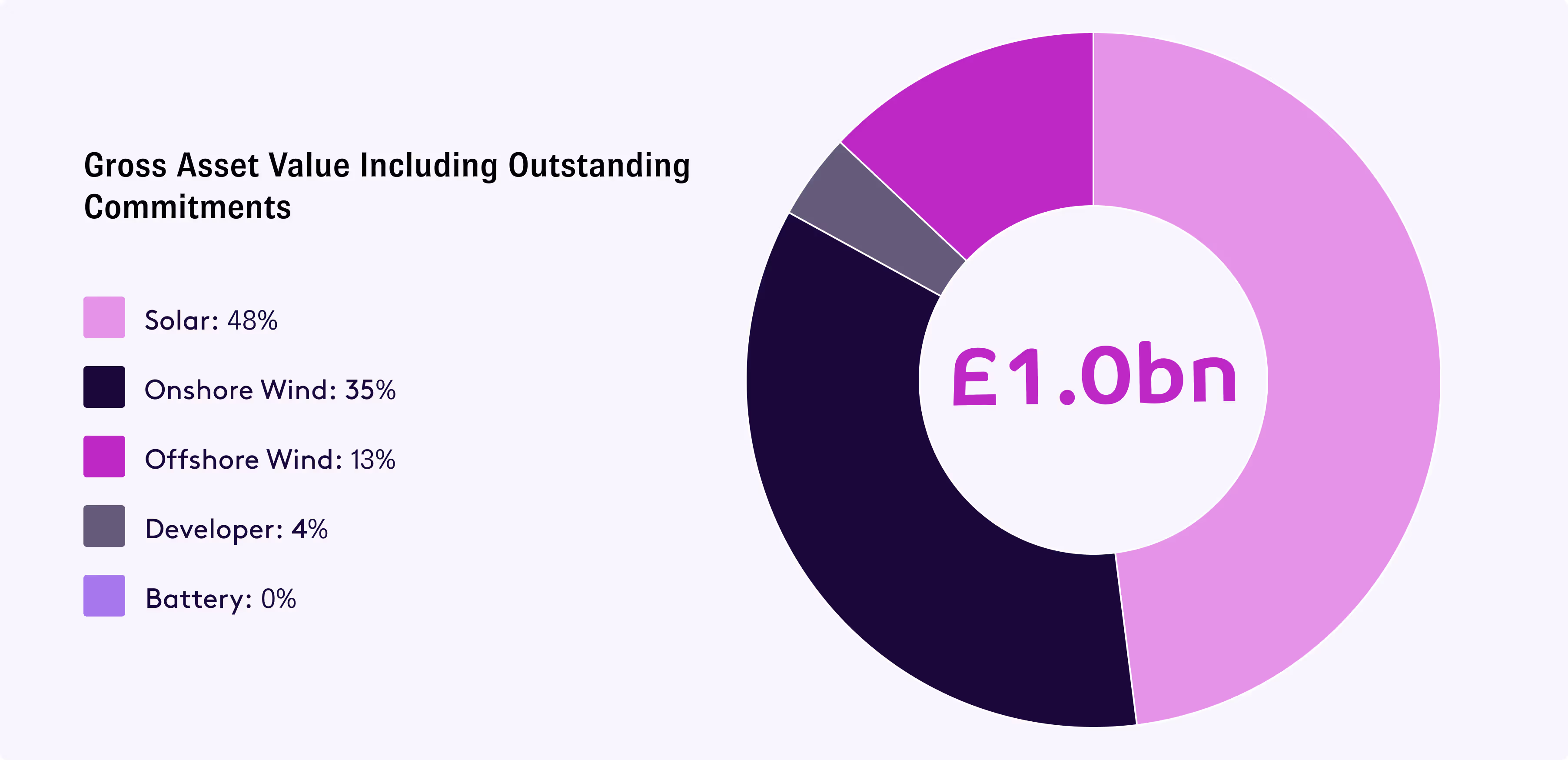

Portfolio

Metrics

(as of 30/06/2025)

* including developer investments

but excluding conditional acquisitions

797

MW*

5

Countries in Europe

£540m

Net Asset Value (NAV)

# of Assets*

40

5

Technologies (incl. tech in developers)

47%

Inflation-linked revenue for the next ten years

85%

Fixed revenue for the next two years

ESG & Impact Strategy

Our Impact Strategy encompasses the core values and activities of our fund: Performance, Planet, and People

Through this comprehensive approach, we integrate ESG risk and strive to maximise environmental and social benefits, going beyond climate change mitigation

Through this comprehensive approach, we integrate ESG risk and strive to maximise environmental and social benefits, going beyond climate change mitigation

Performance

We prioritise the operational performance of our assets to align with our impact goals

Planet

Our focus is on the energy transition journey towards achieving net zero

People

We are committed to avoiding harm to local communities and creating opportunities for social benefits